Gold, the Big Winner of Market Upheavals

U.S. Treasuries, supposed to be the ultimate refuge in times of crisis, appear to have been swept away by the market swell, while gold remains afloat.

Read article

U.S. Treasuries, supposed to be the ultimate refuge in times of crisis, appear to have been swept away by the market swell, while gold remains afloat.

Read article

Many investors have not bought gold recently as they have been waiting for a correction. But we have told investors that gold is very unlikely to pause at this level. Instead, once properly past $3,000, we are likely to see an acceleration.

Read article

With unprecedented levels of debt and rising interest rates undermining bond markets, confidence in sovereign debt is eroding. In the face of this systemic risk, gold is once again the safe-haven asset par excellence.

Read article

Over the past two decades, central bank reserves have undergone profound changes as ideologies have been renewed. De-dollarization is gradually establishing itself as a marker of the decline of the United States, while sovereign assets occupy a growing place, symbolizing the transition to a new w...

Read article

Any major correction in gold is unlikely until it has reached much, much higher prices. Thus, anyone watching conventional overbought indicators will miss the Gold Wagon.

Read article

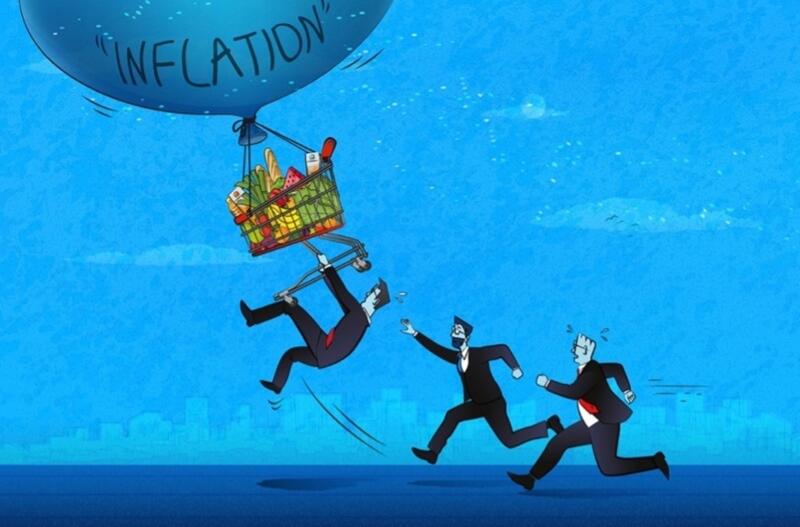

In the USA, inflation is set to rise again due to disruptions in supply chains. But for Europe, the situation is even more critical: in addition to these supply tensions, it will have to contend with soaring interest rates, a further factor in inflationary pressure. The risk of worsening stagflat...

Read article

Apparently Trump’s motto is: Go big or go home. Gold at $2,900 values the US’s 8,100 tonne at a measly $0.8 T. Do you really think he’s going to tweak the monetary system to put a lousy $0.8 trillion onto the balance sheet?

Read article

Gold is the barometer of current events, and as such, it sends out a very strong signal. At a time when the global economy is reeling under the effects of financial instability, trade wars and geopolitical conflicts, the yellow metal is racking up record after record.

Read article

Physical gold now plays the same role in the United States as it did in China last year: a safe alternative in the face of economic and financial instability.

Read article

After successive interest rate hikes, prices finally seem to be slowing down, but there are still many uncertainties. So can we look forward to a return to normal, or should we expect a new economic reality marked by high inflation?

Read article